While brands and marketers gear up for the 2026 FIFA World Cup and work to understand the right audiences and segments to target to have their messaging heard, there’s an audience we’d like to highlight: those who play video games and are either already locked into the soccer fandom or may become interested as hype continues to build in the coming months.

Traditional sports marketing focuses heavily on assets like stadium sponsorships, jersey deals, experiential activations, and more. While each is a key cog in the marketing wheel, the gaming audience isn’t just bigger than many realize, its fandom is greater and its openness to brands creates unique marketing advantages worth consideration.

Gamers Are Premium Brand Targets

Let’s start with the audience. We took a look at a recent YouGov dataset (July 20, 2025) to better understand video game-playing soccer fans and the data revealed they’re more sophisticated and brand-receptive than many marketers might expect.

Soccer fans are significantly more likely to be active gamers than the general population. Among soccer fans, 53% played video games in the last six months compared to 44% nationally. More importantly, 44% purchased at least one video game in the same period, well above the 35% national average. This indicates not just casual engagement, but active investment in gaming.

Among those who both play and purchase games, sports gaming shows strong preference rates. Of audiences that played or purchased video games in the last six months, 28% prefer sports video games as their gaming genre, significantly higher than the 10% national average. Additionally, 17% of this gaming audience considers soccer a core sport they follow, compared to just 9% nationally.

The intersection creates a premium target segment. When we combine all three factors – people who play games, purchase games, consider soccer a core sport, AND prefer sports games as their genre – we get a highly valuable audience of 8.1 million people with distinct characteristics:

- Younger demographics dominate: 89% are Gen Z + Millennial (versus 45% nationally)

- Strong male skew: 85% male (compared to 48% nationally)

- Diverse ethnic composition: 47% White (63% national), 26% Hispanic (16% national), 23% Black (12% national)

- Higher income bracket: 34% earn over $100k annually (20% national)

Most critically for marketers, this audience shows exceptional brand receptivity. Among this core segment of soccer fans who game, 62% view brands more favorably when they sponsor teams or leagues they care about, compared to just 23% nationally. That’s a 170% lift in brand favorability – representing one of the most brand-receptive audiences in sports marketing.

This creates a unique marketing environment where brands can reach a concentrated, affluent audience that doesn’t just tolerate partnerships but actively appreciates them when done authentically.

Soccer Gaming Landscape is Diverse

The soccer gaming market has evolved far beyond a single dominant platform or game. Today’s landscape offers multiple avenues for brand engagement, each with distinct audiences and partnership opportunities. Here are some of the big players—you’re likely aware of at least a few.

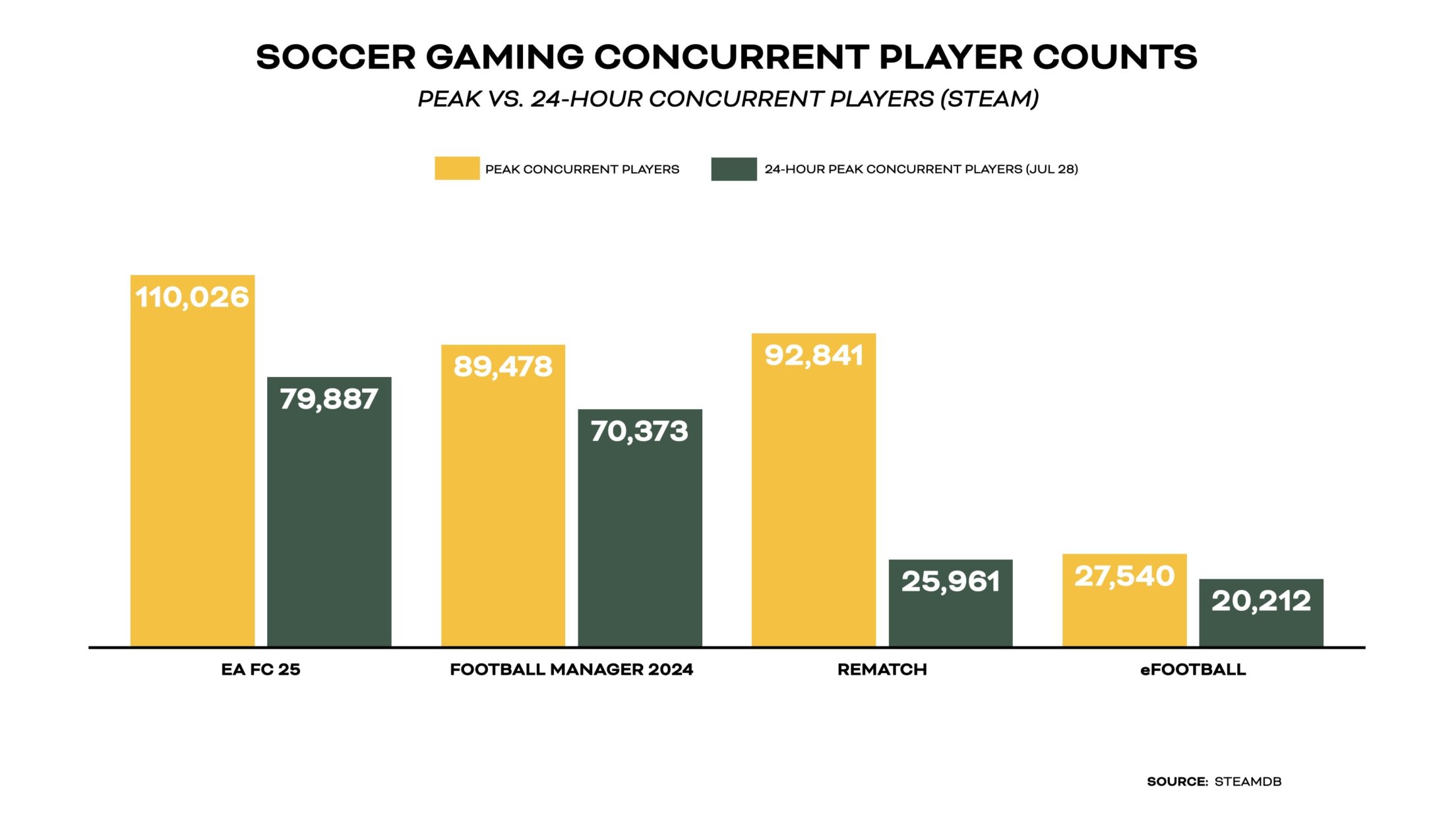

EA Sports FC continues its market dominance with 2025 edition peaking at 110,026 concurrent players on Steam alone. This represents EA’s continuation of the FIFA franchise with exclusive licensing deals and the Ultimate Team mode that generates significant revenue. The game appeals to mainstream soccer fans who want authentic team experiences.

Football Manager 2024 serves a completely different audience despite impressive numbers: 89,478 peak concurrent players who represent the strategic, analytical side of soccer fandom. This simulation appeals to serious soccer tacticians and industry professionals who value realistic player databases and long-term career progression. The consistency of engagement (70,373 players in recent 24-hour periods) shows remarkable loyalty.

eFootball takes the free-to-play approach and peaked at 27,540 concurrent players on Steam, focusing on accessible gameplay and mobile-first design. While smaller in raw numbers, the 20,212 recent concurrent players indicate a stable, dedicated community that values Konami’s alternative approach to soccer simulation.

Rematch represents the most intriguing—and recent—disruption, achieving 92,841 peak concurrent players despite launching just over a month ago in June 2025. This newcomer features arcade-style 5v5 matches that blend competitive gaming with soccer authenticity, proving there’s appetite for innovation and something more accessible to fans and non-fans alike in the space.

Note: These Steam statistics represent PC gaming exclusively

What’s particularly interesting for marketers is how these different platforms create distinct opportunities. EA Sports FC offers massive reach and established brand integration pathways. Football Manager provides access to soccer’s analytical audience and industry professionals. eFootball delivers cost-effective access to dedicated fans. And Rematch offers early-stage partnership opportunities with an innovative, rapidly growing platform.

The diversity means brands don’t have to put all their eggs in one basket. Different companies can find their ideal audience match while exploring various partnership models across the ecosystem.

How Brands Can Leverage Soccer Gaming

The most effective soccer gaming partnerships don’t feel like advertising. They enhance the gaming experience while building positive brand associations. The beauty of video games is you can get as creative as you want, which should be good news for brands—provided any idea can be and feel authentic.

Importantly, these ideas don’t have to only focus on major tournaments like the World Cup. They can be about what comes after the final whistle to create sustained engagement, especially given how long game development takes. There’s an infinite list of innovative and impactful integration ideas that go beyond traditional sponsorship models, but here are five to get you thinking:

Stadium Atmosphere Sponsorships: Sponsor environmental storytelling that changes gameplay. Myabe “Red Bull Storm Mode” could trigger intense weather during crucial games, while “McDonald’s Golden Hour” creates beautiful sunset lighting with enhanced player performance.

Real-Time Brand Cameo Events: Integrate live brand activations during actual gameplay. During UEFA Champions League games, Amazon Prime could spawn special delivery drones that drop power-ups. This bridges the gap between real soccer and virtual experiences, creating moments that feel both surprising and natural within the gaming world.

Branded Manager AI Personalities: In Football Manager, create AI assistants with personalities associated with a brand. The “Rivian Analytics Assistant” could provide data-driven insights about your players or your opponents. Or the “Visa Financial Scout” might deliver strategic player acquisition advice with investment metaphors.

Product Placement Evolution Systems: Design equipment and gear that actually impacts gameplay and evolves over time. Nike boots could gradually improve a player’s shooting accuracy, while Adidas gear enhances passing precision. The key is making these feel like genuine performance enhancements rather than static billboards.

Social Commerce Integration Seamlessly blend gaming with real-world purchasing. EA FC players could customize virtual jerseys and immediately order physical versions through club partnerships. This turns gaming inspiration into immediate sales opportunities, creating a direct path from virtual engagement to real-world revenue.

The most effective partnerships feel like natural extensions of soccer culture rather than forced advertisements. When done well, they create positive brand associations that translate into real-world preference and purchasing behavior.

Soccer gaming marketing represents access to an engaged audience that actively appreciates brand partnerships when done authentically. The demographic data shows soccer fans are significantly more likely to be gamers, more likely to purchase games, and dramatically more likely to view sponsoring brands favorably.

With multiple platforms offering different partnership opportunities and new competitors proving there’s appetite for innovation, brands have diverse pathways to reach their target audiences. The opportunity exists today, with or without major tournaments.

For marketing professionals, soccer gaming isn’t just another channel option. It’s an avenue for reaching audiences where they actually spend their time and attention—and their money.